The quantum computing space has long been hailed as the next big leap in technology, promising breakthroughs in industries ranging from healthcare to finance. However, the market’s optimism surrounding quantum computing stocks faced a harsh reality check recently., underscoring the speculative nature of investing in quantum computing stocks.

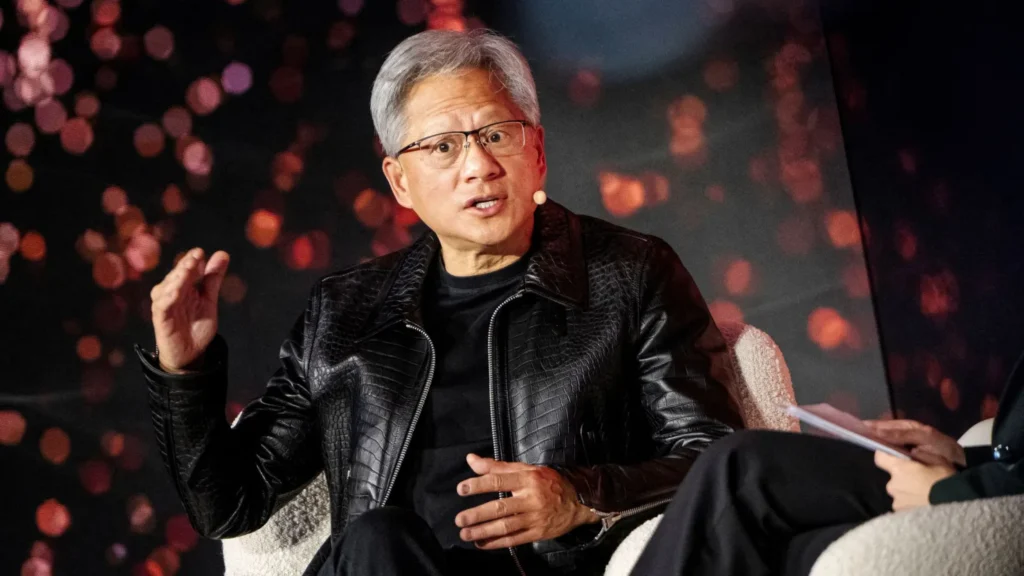

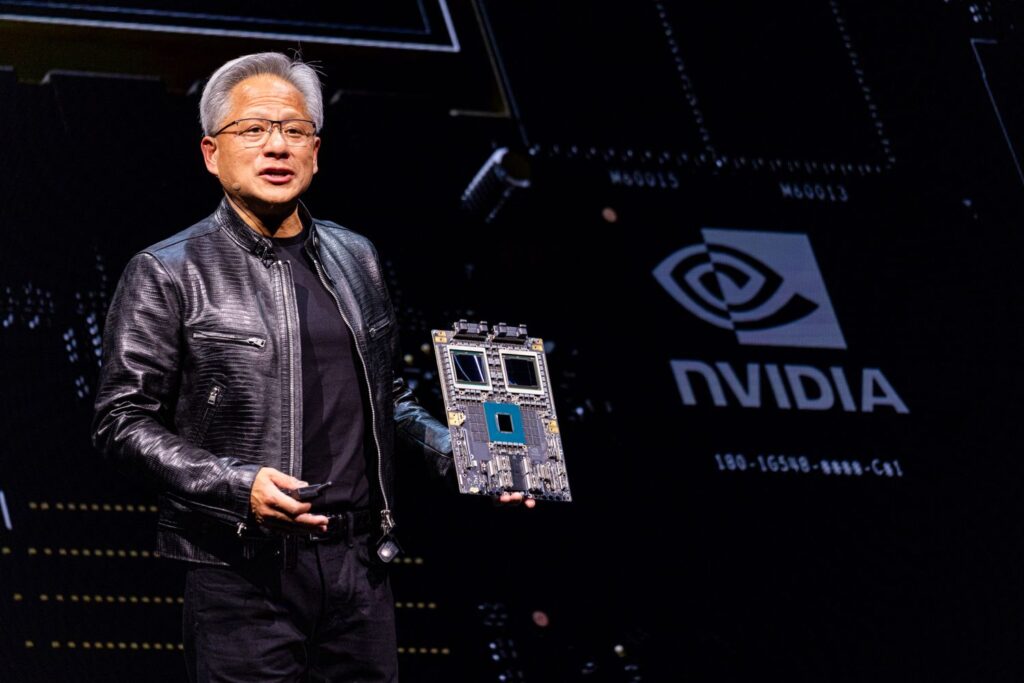

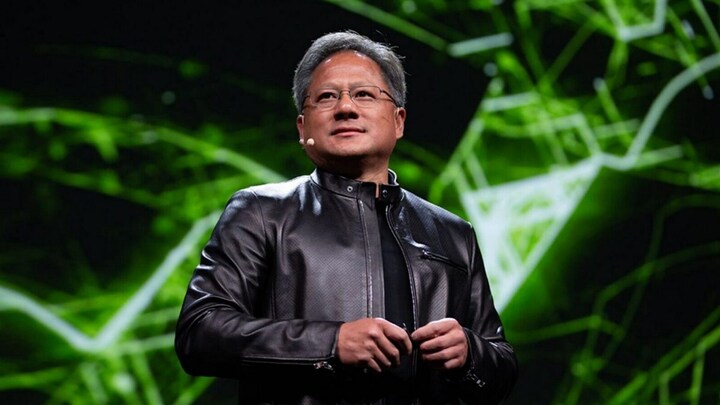

Shares of prominent quantum computing companies, including Rigetti Computing, plummeted after Nvidia CEO Jensen Huang’s remarks about the timeline for practical quantum computers. Huang’s statement that quantum computers are still 15 to 30 years away from viability has left investors reconsidering their positions.

The Current State of Quantum Stocks

Quantum stocks have attracted significant attention in recent years, with companies like Rigetti Computing, IonQ, and D-Wave leading the charge. These firms have been at the forefront of developing quantum technologies, securing investments, and making headlines with promises of revolutionary advancements. However, the sector remains highly speculative, with revenues still far from matching the hype.

Huang’s comments acted as a reality check for many investors. While quantum computing’s potential is undeniable, the timeline to achieve commercially viable quantum systems remains uncertain. This has put pressure on quantum stocks, which often trade at valuations that reflect lofty expectations rather than current performance.

Why Huang’s Words Carry Weight

Jensen Huang is a respected figure in the tech world, and his insights carry significant weight. As the CEO of Nvidia, a company at the forefront of AI and high-performance computing, Huang has a deep understanding of the technological landscape.

During a recent keynote, Huang emphasized the immense challenges that still need to be overcome for quantum computing to become practical. His estimate of a 15- to 30-year timeline is based on current progress in quantum hardware, error correction, and software development.

“Quantum computing is incredibly promising, but the path to practical applications is long and arduous,” Huang said. His words struck a nerve with investors who had been betting on quicker returns from the quantum sector.

Market Reaction: Quantum Stocks Take a Hit

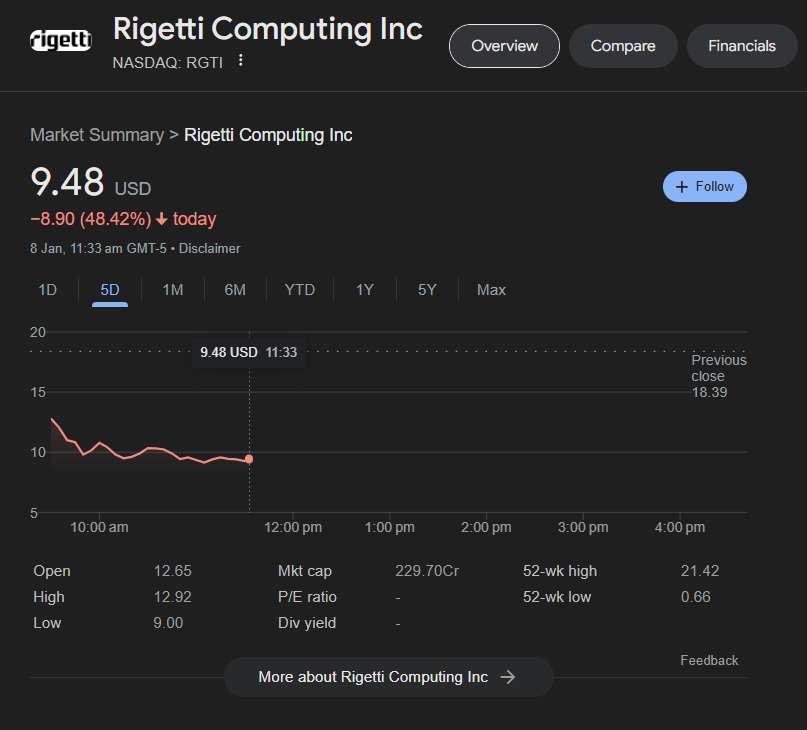

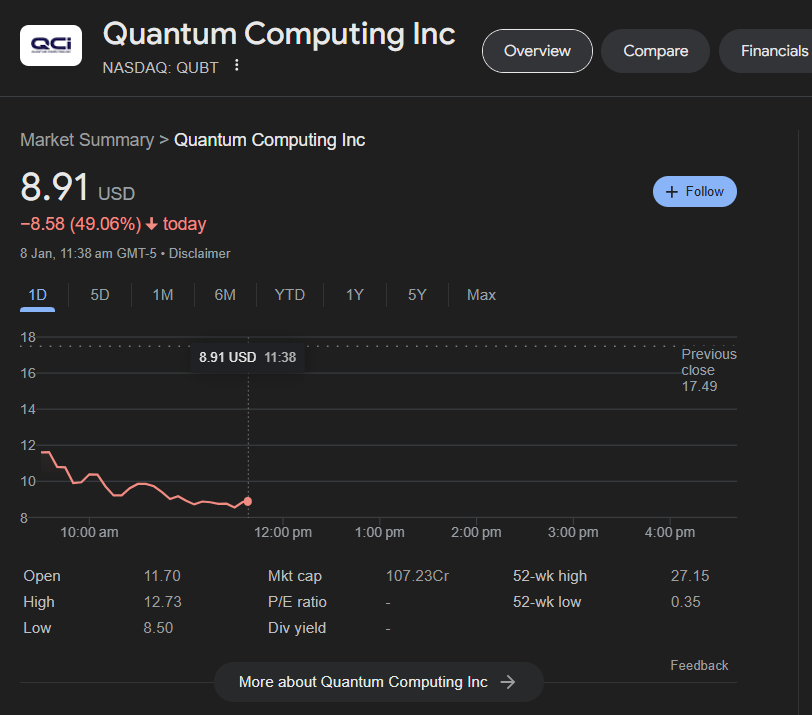

Following Huang’s remarks, shares of quantum computing companies like Rigetti Computing saw significant declines. The market’s reaction underscores the speculative nature of investing in emerging technologies. While these companies are pioneers in their field, they face immense challenges, including technological hurdles, high capital requirements, and competition from established tech giants.

For instance, Rigetti Computing’s stock dropped by double digits in the wake of Huang’s comments. Similar trends were observed for other quantum-focused firms. This sudden downturn highlights the volatility associated with quantum stocks, making them a risky investment for those seeking short-term gains.

The Challenges Facing Quantum Computing

Huang’s projection of a 15- to 30-year timeline isn’t baseless. Quantum computing faces numerous technical and practical challenges:

- Hardware Scalability: Building quantum computers with a sufficient number of stable qubits remains a daunting task.

- Software Development: Quantum computing requires a completely new software ecosystem. Programming quantum computers is vastly different from traditional systems, and this field is still in its infancy.

- High Costs: Quantum research and development are expensive, requiring substantial investments without immediate returns.

Long-Term Potential Still Intact

Despite the challenges, the long-term potential of quantum computing remains enormous. The technology promises to solve problems that are currently intractable for classical computers. From optimizing supply chains to accelerating drug discovery and revolutionizing cryptography, quantum computing has the potential to transform industries.

For investors, the key takeaway is that quantum stocks represent a long-term play. Those willing to weather the volatility and wait for decades could potentially reap significant rewards. However, patience and a high-risk tolerance are essential.

Should You Invest in Quantum Stocks Now?

Given the recent downturn, many investors are questioning whether quantum stocks are worth the risk. Here are a few considerations:

- Risk vs. Reward: Quantum stocks are highly speculative. While they offer the potential for outsized returns, they also come with significant risks.

- Diversification: If you’re interested in the quantum space, consider diversifying your portfolio to mitigate risk. Investing in broader tech funds that include quantum players alongside established companies may be a safer approach.

- Stay Informed: Keep an eye on technological advancements, partnerships, and funding announcements in the quantum space. These can provide insights into the sector’s progress and potential tipping points.

- Focus on Fundamentals: While quantum computing companies may not yet have strong revenue streams, it’s essential to evaluate their leadership, partnerships, and technological capabilities.

Conclusion: A Reality Check for Quantum Stocks

Huang’s comments have served as a reminder that groundbreaking technologies often take decades to mature. While quantum computing holds immense promise, the road to commercial viability is long and fraught with challenges. For now, quantum stocks remain a speculative bet, more suited for investors with a high-risk appetite and a long-term outlook.

As the industry continues to evolve, staying informed and tempering expectations will be crucial for navigating the quantum landscape. For those willing to take the plunge, the potential rewards could be transformative—but only if they’re prepared to wait for the long haul.