In a surprising turn of events, General Motors (GM) has decided to exit the autonomous taxi (robotaxi) market through its Cruise division. This high-profile move has sent shockwaves through the tech and automotive industries, revealing a critical lesson about the risks of scaling too quickly in a rapidly evolving sector.

Let’s unpack what led to GM’s robotaxi exit, its implications, and the broader message it sends to innovators and investors alike.

The Ambitious Vision of GM’s Robotaxi Endeavor

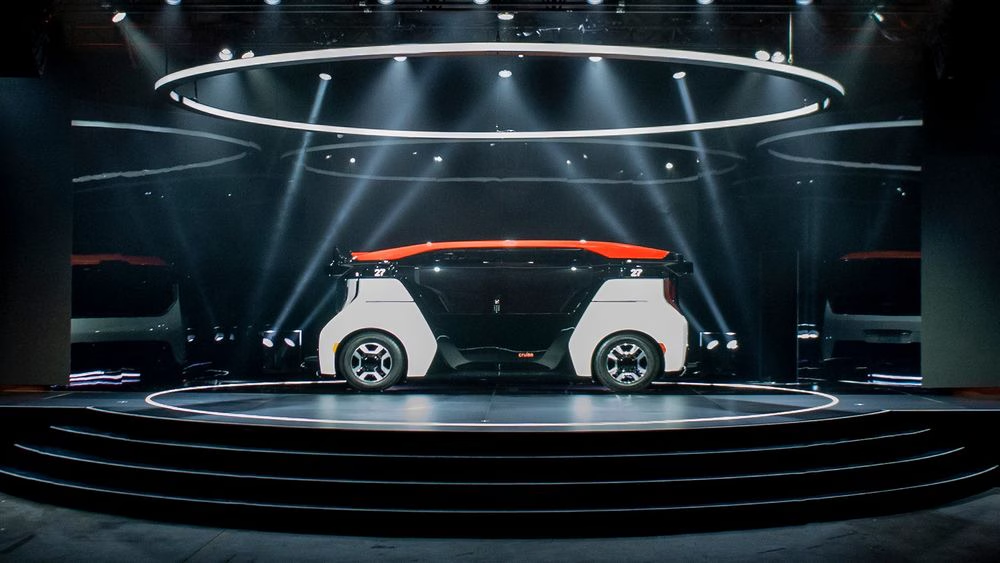

GM launched Cruise with a vision to revolutionize urban transportation. By leveraging cutting-edge AI and autonomous driving technology, Cruise aimed to deploy a fleet of driverless cars in bustling cities, offering safer, more efficient, and environmentally friendly transportation.

The division even secured permits to test its services in cities like San Francisco, making headlines and raising investor confidence.

The promise of a future where cars drive themselves was tantalizing. However, as GM’s robotaxi exit highlights, the road to this future is fraught with challenges that can derail even the most ambitious plans.

Why GM’s Robotaxi Exit Happened

1. Scaling Too Fast Without Sufficient Infrastructure

Scaling a robotaxi service requires a robust and well-tested infrastructure, something that Cruise struggled to achieve. The rapid expansion of its fleet exposed vulnerabilities in its autonomous systems, including safety concerns and technical glitches.

Without a mature infrastructure to support large-scale operations, scaling too fast led to “serious problems” that GM couldn’t ignore.

2. Regulatory and Safety Roadblocks

Autonomous vehicles operate in a highly regulated environment. Despite significant advancements, regulatory bodies demand extensive safety testing and compliance, especially in densely populated urban areas.

Cruise faced scrutiny after a series of incidents, including collisions involving its robotaxis. This not only hampered public trust but also attracted tighter regulatory oversight, increasing operational challenges.

3. Mounting Costs and Uncertain ROI

The high costs associated with developing and maintaining autonomous technology were a key factor in GM’s decision to pull the plug. Despite billions of dollars in investments, Cruise failed to deliver the returns GM had hoped for.

Tesla vs. Cruise: A Comparative Analysis

| Feature/Aspect | Tesla | Cruise |

|---|---|---|

| Parent Company | Tesla, Inc. | General Motors (GM) |

| Focus | Autonomous and EV integration | Dedicated autonomous vehicles |

| Deployment Model | Gradual integration in EVs | Fleet-based robotaxis |

| Testing Grounds | Global, with real-world roads | Limited to select U.S. cities |

| Safety Record | Mixed, with high-profile cases | Under scrutiny post-incidents |

| Financial Strategy | Self-funded via EV sales | Heavily reliant on GM funding |

| Public Perception | Strong brand loyalty | Trust issues post-exit |

| Technology Edge | Full Self-Driving (FSD) beta | Specialized robotaxi software |

With competition intensifying and profitability remaining elusive, continuing the robotaxi venture no longer aligned with GM’s strategic priorities.

Lessons for the Industry

The challenges faced by GM’s Cruise division offer valuable lessons for businesses navigating the complex landscape of innovation in emerging technologies. The key takeaways include:

1. Innovation Must Be Paced

GM’s robotaxi exit underscores the importance of pacing innovation. While being a first mover can offer competitive advantages, it also comes with risks.

Rapid scaling without addressing foundational challenges can lead to costly mistakes that set projects back rather than propel them forward.

2. Public Trust is Paramount

Autonomous vehicles are still a new concept for most people. Incidents involving safety breaches can erode public trust, which is essential for the success of such technologies.

Companies entering this space must prioritize safety and transparency to build confidence among users and regulators.

3. Strategic Alignment Matters

Not every innovation aligns with a company’s long-term goals. GM’s decision to exit the robotaxi market reflects a strategic pivot, possibly towards other avenues like electric vehicles (EVs) and connected car technologies, where the company sees greater potential for growth and profitability.

The Future of Robotaxis

While GM’s robotaxi exit may seem like a setback, it’s far from the end of autonomous driving technology. Other players, including Tesla, Waymo, and Uber, continue to invest heavily in this space. These companies are learning from GM’s experience, adopting more measured approaches to scaling and addressing challenges more systematically.

Collaboration is Key

Partnerships between tech companies, automakers, and cities can accelerate the development of autonomous ecosystems. By working together, stakeholders can create solutions that are safer, more efficient, and more appealing to the public.

Incremental Growth Over Big Bang Launches

Instead of aiming for full-scale deployment right away, companies should focus on incremental growth. Testing autonomous vehicles in controlled environments, gradually expanding to more complex scenarios, and incorporating real-world feedback can mitigate risks and build a stronger foundation for success.

Conclusion: A Cautionary Tale for Innovators

GM’s robotaxi exit serves as a cautionary tale about the perils of scaling too fast in an uncharted territory. While the dream of autonomous transportation remains alive, the challenges Cruise faced highlight the importance of strategic planning, public trust, and financial sustainability.

As the industry continues to evolve, GM’s decision will undoubtedly shape how other companies approach the robotaxi market. For now, the spotlight shifts to the remaining players who must navigate these challenges while keeping the vision of a driverless future alive. One thing is clear: innovation, when tempered with patience and precision, has the power to transform the way we move.

1 thought on “GM’s Robotaxi Exit: A Billion-Dollar Mistake in Scaling Too Fast”